Robert McArtor shares a graph that explores whether we are STILL in a Sellers Market going into 2019.

There are many unsubstantiated theories about what is happening with home prices in the Baltimore, Harford County areas. From those who are worried that prices are falling (data shows this is untrue), to those who are concerned that prices are again approaching boom peaks because of “irrational exuberance” (this is also untrue as prices are not at peak levels when they are adjusted for inflation), there seems to be no shortage of opinion.

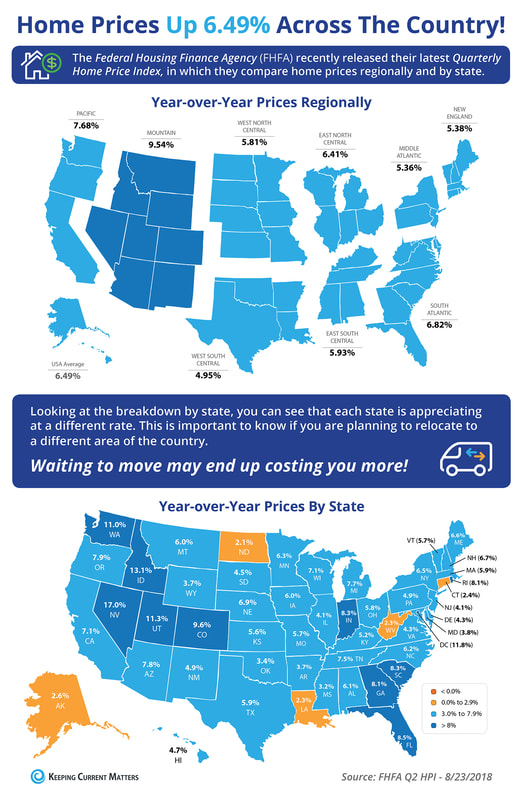

However, the increase in prices is easily explained by the theory of supply & demand. Whenever there is a limited supply of an item that is in high demand, prices increase. It is that simple. In real estate, it takes a six-month supply of existing salable inventory to maintain pricing stability. In most housing markets, anything less than six months will cause home values to appreciate and anything greater than seven months will cause prices to depreciate FREE Home Valuation Report for the Baltimore Metro Area and Surrounding Counties Some Highlights:

Here are five reasons why listing your Maryland home for sale this fall makes sense.

1. Demand Is StrongThe latest Buyer Traffic Report from the National Association of Realtors (NAR) shows that buyer demand remains very strong throughout the vast majority of the country. These buyers are ready, willing and able to purchase…and are in the market right now! In fact, more often than not, multiple buyers end up competing with each other to buy the same homes. Take advantage of the buyer activity currently in the market. 2. There Is Less Competition Now Maryland Housing inventory is still under the 6-month supply needed for a normal housing market. This means that, in the majority of the country, there are not enough homes for sale to satisfy the number of buyers in the market. This is good news for homeowners who have gained equity as their home values have increased. However, additional inventory could be coming to the market soon! Historically, a homeowner stayed in his or her home for an average of six years, but that number has hovered between nine and ten years since 2011. Many homeowners have a pent-up desire to move as they were unable to sell over the last few years because of a negative equity situation. As home values continue to appreciate, more and more homeowners will be given the freedom to move. The choices buyers have will continue to increase. Don’t wait until this other inventory comes to market before you decide to sell. 3. The Process Will Be QuickerToday’s competitive environment has forced buyers to do all that they can to stand out from the crowd, including getting pre-approved for their mortgage financing. This makes the entire selling process much faster and much simpler as buyers know exactly what they can afford before home shopping. According to Ellie Mae’s latest Origination Insights Report, the average time it took to close a loan was 44 days. 4. There Will Never Be a Better Time to Move UpIf your next move will be into a premium or Maryland Luxury Homes, now is the time to move up! The abundance of inventory available in these higher price ranges has created a buyer’s market for anybody looking to purchase these homes. This means that if you are planning on selling a starter or trade-up home, your home will sell quickly AND you’ll be able to find a premium home to call your own! According to CoreLogic, prices are projected to appreciate by 5.1% over the next year. If you are moving to a higher-priced home, it will wind up costing you more in raw dollars (both in down payment and mortgage payment) if you wait. Start searching for homes now 5. It’s Time to Move on With Your Life Look at the reason you decided to sell in the first place and determine whether it is worth waiting. Is money more important than being with family? Is money more important than your health? Is money more important than having the freedom to go on with your life the way you feel you should? Only you know the answers to the questions above. You have the power to take control of the situation by putting your home on the market. Perhaps the time has come for you and your family to move on and start living the life you desire. Contact Robert McArtor, Team Leader with Maryland Homes Team of RE/MAX Components today at 443-885-0875 or visit our Website today and start your home search. Receive a FREE HOME VALUATION generated by one of our Team Members. That is what is truly important. Here are five reasons listing your home for sale in Maryland this summer makes sense.

1. Demand Is Strong. The latest Buyer Traffic Report from the National Association of Realtors (NAR) shows that buyer demand remains very strong throughout Maryland, Baltimore Metro and Harford County and the vast majority of the country. These buyers are ready, willing and able to purchase…and are in the market right now! More often than not, multiple buyers are competing with each other to buy the same home. Take advantage of the buyer activity currently in Maryland. 2. There Is Less Competition NowHousing inventory has declined year-over-year for the last 35 months and is still under the 6-month supply needed for a normal housing market. This means that, in the majority of the country, there are not enough homes for sale to satisfy the number of buyers in the market. This is good news for homeowners who have gained equity as their home values have increased. However, additional inventory could be coming to the market soon. Historically, the average number of years a homeowner stayed in his or her home was six, but that number has hovered between nine and ten years since 2011. There is a pent-up desire for many homeowners to move as they were unable to sell over the last few years because of a negative equity situation. As home values continue to appreciate, more and more homeowners will be given the freedom to move. The choices buyers have will continue to increase. Don’t wait until this other inventory comes to market before you decide to sell. 3. The Process Will Be QuickerToday’s competitive environment has forced buyers to do all they can to stand out from the crowd, including getting pre-approved for their mortgage financing. This makes the entire selling process much faster and much simpler as buyers know exactly what they can afford before home shopping. According to Ellie Mae’s latest Origination Insights Report, the average time it took to close a loan was 41 days. 4. There Will Never Be a Better Time to Move Up If your next move will be into a premium or luxury home, now is the time to move up! The inventory of homes for sale at these higher price ranges has forced these markets into a buyer’s market. This means that if you are planning on selling a starter or trade-up home, your home will sell quickly, AND you’ll be able to find a premium home to call your own! Prices are projected to appreciate by 5.2% over the next year, according to CoreLogic. If you are moving to a higher-priced home, it will wind up costing you more in raw dollars (both in down payment and mortgage payment) if you wait. 5. It’s Time to Move on With Your LifeLook at the reason you decided to sell in the first place and determine whether it is worth waiting. Is money more important than being with family? Is money more important than your health? Is money more important than having the freedom to go on with your life the way you think you should? Only you know the answers to the questions above. You have the power to take control of the situation by putting your home on the market. Perhaps the time has come for you and your family to move on and start living the life you desire. That is what is truly important. Contact Robert McArtor with Maryland Homes Team of RE/MAX Components to get started with your HOME SEARCH in MARYLAND today! Maryland Mortgage interest rates have risen by more than half of a point since the beginning of the year, and many assume that if mortgage rates rise, Baltimore Metro home values will fall. History, however, has shown this not to be true.

Where are Maryland home values today compared to the beginning of the year?While rates have been rising, so have home values. Here are the most recent monthly price increases reported in the Home Price Insights Report from CoreLogic:

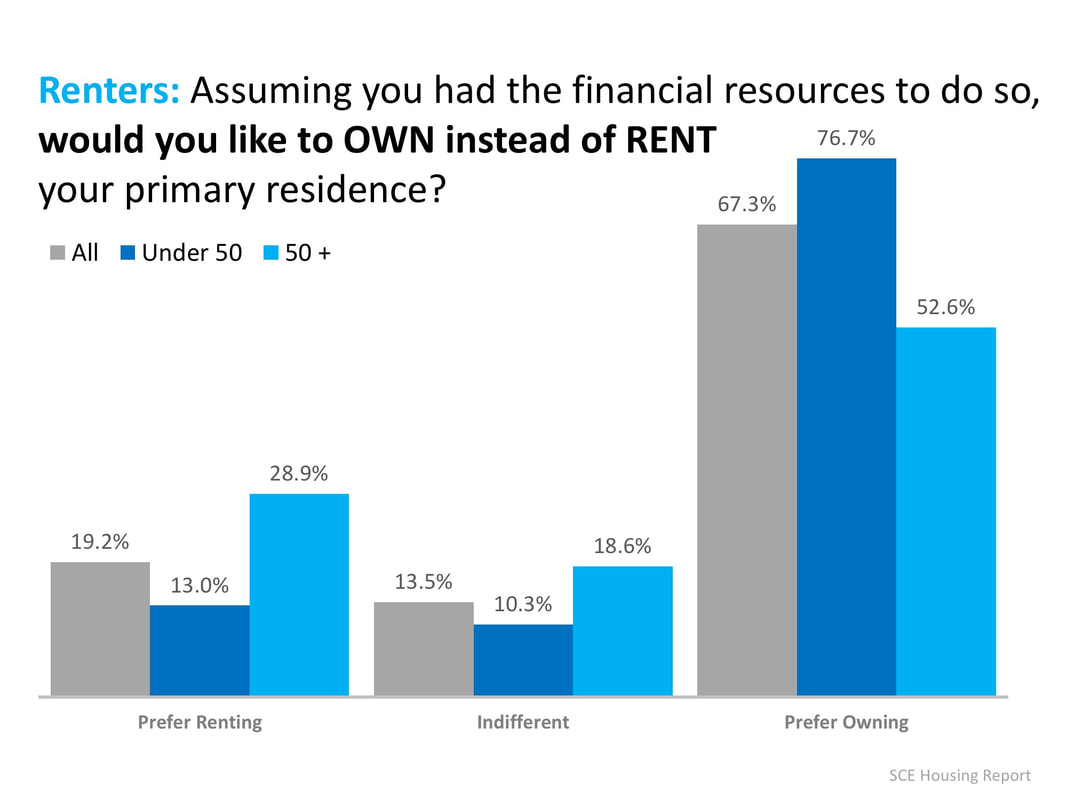

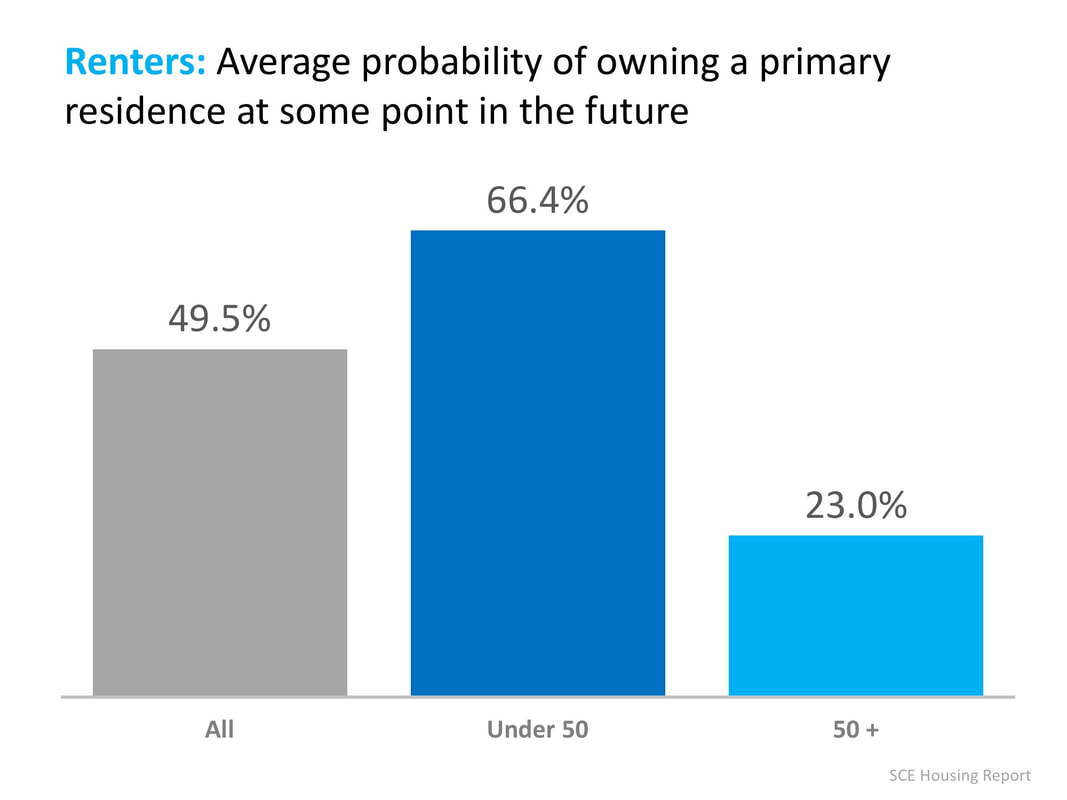

How can prices rise while mortgage rates increase?Freddie Mac explained in a recent Insight Report: “In the current housing market, the driving force behind the increase in prices is a low supply of both new and existing homes combined with historically low rates. As mortgage rates increase, the demand for home purchases will likely remain strong relative to the constrained supply and continue to put upward pressure on home prices.” Bottom LineIf you are thinking about moving up to your dream home in Maryland, waiting until later this year and hoping for prices to fall may not be a good strategy. Start your Home Search with Maryland Homes Team's Virtual Search Map that is directly tied to their MLS. You will enjoy "Flying" into cities of your choice and saving the properties you want to visit later. Simply start your property organization account and get started today! Every year, the New York Federal Reserve publishes the results of their Survey of Consumer Expectations (SCE). Each survey covers a wide range of topics including inflation, labor market, household finance, credit access and housing. One of the many questions asked in the housing section of the survey was: Assuming you had the financial resources to do so, would you like to OWN a Home in Maryland instead of RENT your primary residence?Over three-quarters of respondents under the age of 50 said that they would prefer to own their home, rather than rent. While only 52.6% of those over 50 would prefer to own. The full breakdown can be found in the chart below. When Maryland renters were asked what the average probability of owning a primary residence at some point in their future was, 66.4% of those under 50 believed that they would eventually own their home, while only 23% of those over 50 did. Bottom LineMany had wondered if young Americans had lost their desire to own a home, but for those renting now, that dream is still alive. If you are currently renting in Maryland, Baltimore, Harford County or surrounding areas and would like to experience the dream of home ownership. NOW is the time. Contact us today, Robert McArtor, Real Estate Professional with Maryland Homes Team of RE/MAX Components at 443-885-0875 or visit our WEBSITE to get started! Equal Housing Opportunity

With home prices in Maryland rising again this year, some are concerned that we may be repeating the 2006 housing bubble that caused families so much pain when it collapsed. Today’s market is quite different than the bubble market of twelve years ago. There are four key metrics that explain why:

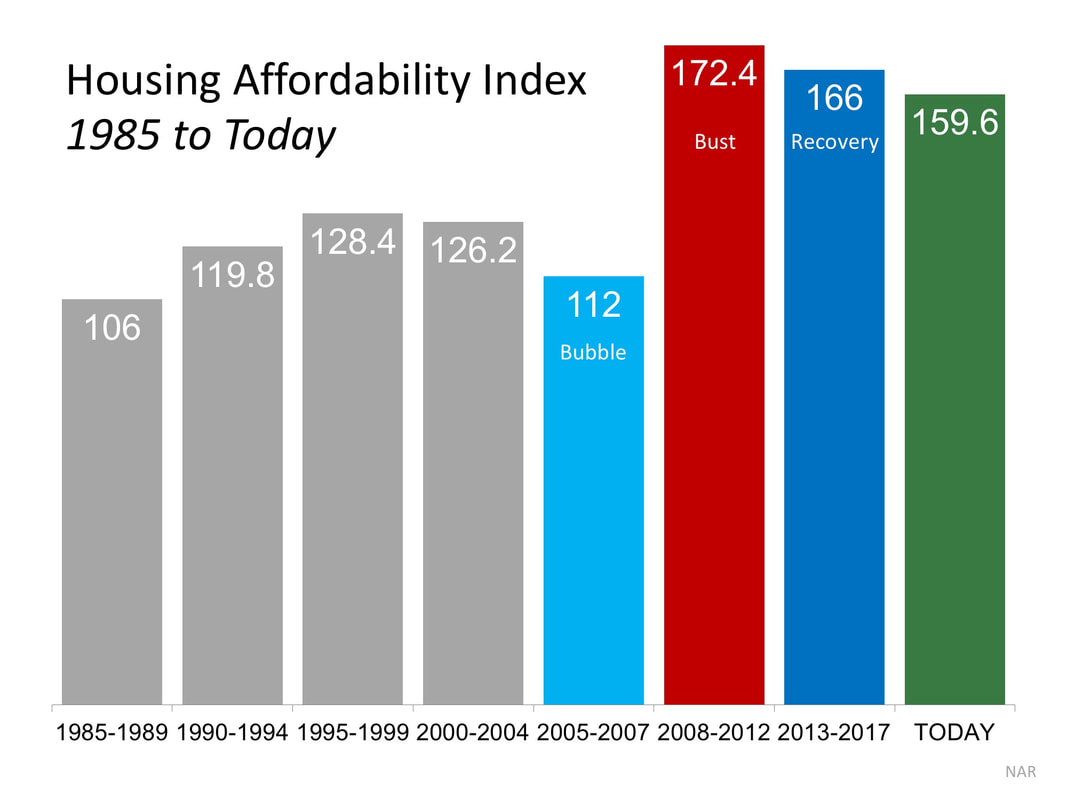

There is no doubt that home prices have reached 2006 levels in many markets across the Maryland and Baltimore Metro Region. However, after more than a decade, home prices should be much higher based on inflation alone. Frank Nothaft is the Chief Economist for CoreLogic (which compiles some of the best data on past, current, and future home prices). Nothaft recently explained to Robert McArtor with Maryland Homes Team, Inc..... “Even though CoreLogic’s national home price index got to the same level it was at the prior peak in April of 2006, once you account for inflation over the ensuing 11.5 years, values are still about 18% below where they were.” (emphasis added) 2. Maryland MORTGAGE STANDARDSSome are concerned that banks are once again easing lending standards to a level similar to the one that helped create the last housing bubble. However, there is proof that today’s standards are nowhere near as lenient as they were leading up to the crash. Need a Mortgage in Maryland? The Urban Institute’s Housing Finance Policy Center issues a Housing Credit Availability Index (HCAI). According to the Urban Institute: “The HCAI measures the percentage of home purchase loans that are likely to default—that is, go unpaid for more than 90 days past their due date. A lower HCAI indicates that lenders are unwilling to tolerate defaults and are imposing tighter lending standards, making it harder to get a loan. A higher HCAI indicates that lenders are willing to tolerate defaults and are taking more risks, making it easier to get a loan.” The graph below reveals that standards today are much tighter on a borrower’s credit situation and have all but eliminated the riskiest loan products. 3. MORTGAGE DEBTBack in 2006, many Maryland homeowners mistakenly used their homes as ATMs by withdrawing their equity and spending it with no concern for the ramifications. They overloaded themselves with mortgage debt that they couldn’t (or wouldn’t) repay when prices crashed. That is not occurring today. The best indicator of mortgage debt is the Federal Reserve Board’s household Debt Service Ratio for mortgages, which calculates mortgage debt as a percentage of disposable personal income. At the height of the bubble market a decade ago, the ratio stood at 7.21%. That meant over 7% of disposable personal income was being spent on mortgage payments. Today, the ratio stands at 4.48% – the lowest level in 38 years! 4. HOUSING AFFORDABILITY in Maryland SEARCH for HOMES ANYWHERE in MARYLAND for SALE With both house prices and mortgage rates on the rise, there is concern that many buyers may no longer be able to afford a home. However, when we look at the Housing Affordability Index released by the National Association of Realtors, homes are more affordable now than at any other time since 1985 (except for when prices crashed after the bubble popped in 2008). Bottom LineAfter using four key housing metrics to compare today to 2006, we can see that the current market is not anything like the bubble market. If you are looking to Sell or Buy a Home anywhere in the Maryland Region including Anne Arundel, Harford, Baltimore and Cecil County. We are here to assist you. Contact Robert McArtor, Real Estate Professional with Maryland Homes Team, Inc. of RE/MAX Components at 443-885-0875 or email him at marylandhomesteam@gmail.com

|

|

Office:

|

|

Your Lifetime Real Estate Agents that are Community minded in Harford County, & Baltimore County. Choosing the right real estate agent and professional is crucial to stress-free and easy home buying or selling in Harford County, & Baltimore County. We have the resources and expertise to guide you through the process. If you have any questions or you're ready to get started, please do not hesitate to call or email us.